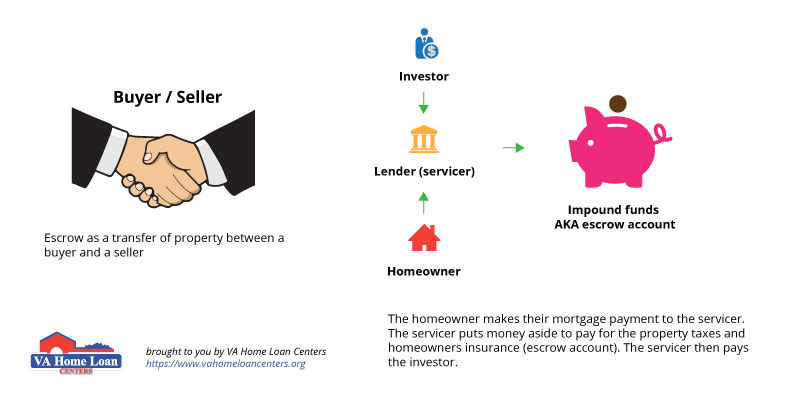

Several types of escrow exist, pertaining to VA home loans; there are three relevant forms of escrow; escrow between the buyer and seller, the process of escrow and an escrow account opened by the loan servicer acting as an intermediary between the lender and homeowner.

Although the VA does not require escrow accounts on VA loans, the vast majority of lenders do.

What is escrow?

Once the terms of sale between the buyer and seller are finalized, the seller puts the property title into escrow, while the buyer puts the funds for purchase into it. These remain in escrow until the sale is closed, at which time the buyer will receive the title and the seller the money.

Once the terms of sale between the buyer and seller are finalized, the seller puts the property title into escrow, while the buyer puts the funds for purchase into it. These remain in escrow until the sale is closed, at which time the buyer will receive the title and the seller the money.

The purpose of escrow is to safeguard the buyer and seller in the event the sale falls through. If this occurs, the title will be returned to the seller and the finances to the buyer, insuring neither changes possession prematurely.

What is the escrow process?

The easiest way to understand the escrow process is by viewing it almost as if it were a police officer in the home buying transaction. Simply put, escrow is a neutral third party that safe guards funds and ensures that all participants involved in the sale play by the rules.

For buyers, sellers, lenders and borrowers, escrow assures that property and money do not change hands until every instruction in the agreement has been followed. Terms are guaranteed to be met because an escrow account will be opened; the required funds from the buyer and the deed to the property from the seller will be deposited into this account, with each party not receiving the deliverable until escrow closes.

The escrow process begins with the selection of an escrow holder; this is done in agreement between the principals involved. Written instructions of the sale are then created and given to the escrow officer. These instructions include:

- Mortgage agreements

- Terms of purchase and price

- The appearance of the buyers title

- Inspection reports

- Date the buyer will possess the property

- All documents to be signed

- Closing costs and charges as well as who pays them and how they will be paid

- Date of Closing

A title search is then conducted on the property. This is done to determine if the seller has any obligations such as a lien. If a lien exists, generally prior to escrow closing, the debt must be paid off by the seller, this can be done out of the escrow account at the completion of the sale.

Escrow then orders any necessary inspections (E.G. termites, title abstract). Next the title search is reviewed by the buyer and seller, upon approval and following the buyer obtaining financing, money is deposited into the escrow account. After reviewing all documentation (E.G. title report, inspection report, loan package etc), agreed upon amendments are made if necessary to the original instructions. The buyer and seller sign off on these amendments and any other required documents and the deal moves forward.

With a targeted closing date, escrow carries out the Title Policy Issuance in conjunction with a Title Insurance agent.

Finally, the escrow account pays off existing claims and liens, creates a final statement of settlement (usually the HUD1), orders a title / deed recording and distributes all policies and contracts and delivers the appropriate funds to the seller (and potentially the buyer), thus closing escrow.

What is an Escrow account?

Because the V.A. has made it obligatory for lenders to ensure that property purchased with a VA loan is covered by sufficient hazard insurance and that property taxes are paid, most lenders use an escrow account known as an impound account through the loan servicer to pay these fees when the bill is due.

The lender wants to secure the borrowers loan repayment, by collecting fees during the escrow process in an impound account for the purpose of paying the property taxes and home insurance, it reduces the homeowners risk of foreclosure. Homeowners’ insurance fees are collected once a year while money for property taxes is collected twice a year.

An escrow analysis is conducted yearly; an account surplus of one sixth the obligation entitles the borrower a refund.

To determine eligibility and to apply for a VA loan, contact VA Home Loan Centers.