In order to begin the process of obtaining a VA Home Loan, the first step is to apply for a certificate of eligibility. This is designed to show that you indeed are entitled to receive VA benefits, including VA financing. Once the VA determines your eligibility, you can move forward and apply for a VA loan.

In order to begin the process of obtaining a VA Home Loan, the first step is to apply for a certificate of eligibility. This is designed to show that you indeed are entitled to receive VA benefits, including VA financing. Once the VA determines your eligibility, you can move forward and apply for a VA loan.

Why a VA loan? If you’re a veteran with qualifying income and credit, you can purchase a primary residence without putting any money down on the purchase price of the home, just as long as the sale price doesn’t exceed the home’s appraised value. While you’ll need money for earnest money, the closing costs may be paid by the seller, which can be negotiated.

There are other advantages to VA home loan for veterans who are ready to purchase:

• VA home loans are assumable, as long as the person who is assuming

the loan is qualified

• The Veterans Administration limits closing costs on the loan, so

you won’t be asked to pay more than what is a fair price

• The VA is ready to assist you if you’re having problems making your

loan payments

• You can always prepay a VA home loan without paying a penalty

It may help to give you some understanding of how the Veterans home loan program came about. It started with the National Housing Act loan program, developed by the Federal Housing Administration of the Department of Housing and Urban Development. It was designed to provide veterans with slightly more favorable loan terms than those available to non-veterans. This gave the VA the role of determining the veteran’s eligibility, and for those veterans who are qualified; the VA will issue a Certificate of Veterans Status, which entitles the veteran to apply for loan benefits for veterans.

Who’s eligible? Any veteran who was discharged under other than dishonorable conditions and gave at least 90 days of service which started prior to September of 1980. The veteran must have served at least 2 years of service.

This is known as the “two year requirement.” If you we enlisted and your service began after September 7, 1980, or your were an officer who began service after October 16, 1981, then you must have completed:

• 2 years continuous service or more, OR

• the full period for which ordered to active duty, for 90 days minimum, or (any part during Congressionally declared war) or 181 continuous days (peacetime)

In order to apply for certificate of eligibility, you’ll need your discharge papers. If you’ve lost your discharge papers, you should apply for a Certificate in Lieu of Lost or Destroyed Discharge. You can contact any VA Veterans Benefits Counselor at your nearest VA office for assistance in getting your proof of military service.

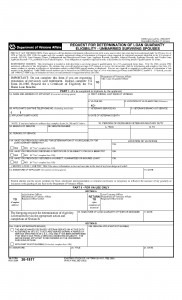

But here’s some good news. If you need assistance with applying for a VA loan or completing your Form 26-1880, professionals at VA Home Loan Centers are ready to help.

Your home loan entitlement never expires. Your eligibility is available as long as you remain on active duty. If you’re discharged, or you’re released from active duty before using your entitlement, the VA must make a new determination of your eligibility. This determination will be made based on your length of service and the type of discharge you will receive.

Eligibility for VA financing is available to veterans who served in a recognized branch of the armed forces for at least 90 days (or less if discharged for a service-related disability) in the following service categories:

• Persian Gulf War (August 2, 1990 to present)

For veterans who served during peacetime, you must have served for at least 181 days and received an honorable discharge. You may have served less if you were discharged for a service-related disability.

If you’re currently on active duty, you’re eligible after serving for at least 90 days. And, if you’re a member of the Reserves or National Guard and have at least 6 years of service with an honorable discharge or have retired, you’re eligible for a GI loan.

There are a variety of other exceptions available that might make you eligible to apply, having to do with medical conditions and hardships. The VA will be happy to provide you with a complete listing of eligibility.

Surviving spouses of active military veterans can also apply for a VA home loan. You’ll need to be an unremarried spouse of a veteran who died while in service or from a service connected disability. You can also apply if you’re a spouse of a serviceperson missing in action or a prisoner of war.

So how much entitlement are you eligible for? Currently, the maximum is $36,000, or up to $104,250 for certain types of loans. If you’ve used all or part of your entitlement, you can get your entitlement back to purchase another home as long as your original loan has been paid back or you meet other requirements.

Once you have your certificate of eligibility, you should apply for your VA loan. Just because you’re eligible, lenders are not required to automatically approve your loan. You have to qualify. Here are some general guidelines about getting approved.

The VA is looking for a good credit score. It doesn’t have to be “great” – just good. They’ll be looking in particular at the last 12 months to be sure you’ve made your payments on time. And some lenders require a minimum credit score, which varies by lender.

They’ll also want to make sure you can pay your mortgage, and also have enough income to pay your other bills as well. Depending on your family size and your location, they will determine your minimum requirements for loan approval.

The VA prefers that you are employed for 2 consecutive years. There are some instances where they’ll waive the 2-year requirement, but it requires documentation and support as to why you have not been steadily employed for 2 years.

Finally, if you’ve had a bankruptcy, the VA requires that you wait 2 years after filing a Chapter 7 bankruptcy discharge, and 1 year after filing a chapter 13 discharge. In addition, they require that there are no late payments in paying off your Chapter 13 bankruptcy.

If you’d like more information, or assistance with applying for a VA loan, the professionals at VA Home Loan Centers are ready to help.

To apply for a VA home loan certificate of eligibility, call 888-573-4496

Or print, and fill out the form below and fax it to 858-754-1300